The insurance industry has always been about managing risk, predicting the unpredictable, and providing peace of mind.

But in today’s fast-paced, tech-driven world, the game is changing. Digital transformation and advanced analytics are no longer buzzwords—they’re the backbone of modern insurance.

Whether you’re an industry professional, a policyholder, or simply curious about how technology is reshaping this age-old sector, this article will guide you through the “how” of digital and analytics in insurance.

Let’s dive in.

The Shift to Digital: Why It Matters

Imagine a world where filing an insurance claim is as easy as sending a text message. Where your policy is tailored to your unique needs, and you’re alerted about potential risks before they even happen. This isn’t science fiction—it’s the reality that digital transformation is bringing to the insurance industry.

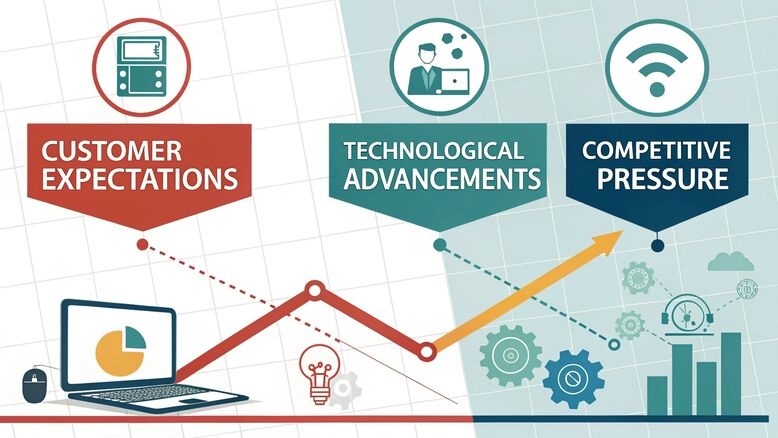

But why is this shift happening now? The answer lies in the convergence of three key factors:

- Customer Expectations: Today’s consumers demand convenience, speed, and personalization. They want to interact with their insurers on their terms, whether that’s through a mobile app, a chatbot, or a quick online form.

- Technological Advancements: From artificial intelligence (AI) to the Internet of Things (IoT), technology is advancing at an unprecedented pace, creating new opportunities for insurers to innovate.

- Competitive Pressure: Insurers who embrace digital tools and analytics gain a significant edge over their competitors, from reducing costs to improving customer satisfaction.

The result? A seismic shift in how insurance companies operate, interact with customers, and manage risk.

Read: Gold Price Fintechzoom – Revolutionizing Gold Price Predictions!

The Role of Analytics: Turning Data into Insights

At the heart of this transformation is data—lots of it. Every policyholder interaction, claim, and transaction generates data. But raw data alone isn’t enough. The real magic happens when insurers use analytics to turn that data into actionable insights.

Here’s how analytics is revolutionizing the industry:

Risk Assessment and Pricing

Traditionally, insurers relied on historical data and broad demographic categories to assess risk and set premiums. But with advanced analytics, they can now analyze a wealth of real-time data to create more accurate risk profiles.

For example, telematics devices in cars can track driving behavior, allowing insurers to offer personalized premiums based on how safely someone drives. Similarly, wearable health devices can provide insights into a policyholder’s lifestyle, enabling more tailored health insurance plans.

Fraud Detection

Insurance fraud is a multi-billion-dollar problem worldwide. Analytics helps insurers detect suspicious patterns and flag potentially fraudulent claims. Machine learning algorithms can analyze vast amounts of data to identify anomalies, such as a sudden spike in claims from a specific region or unusual billing patterns from a healthcare provider.

Customer Experience

Analytics isn’t just about crunching numbers—it’s also about understanding people. By analyzing customer behavior and preferences, insurers can create more personalized experiences. For instance, predictive analytics can help identify when a customer might be considering switching providers, allowing the insurer to proactively address their concerns.

Operational Efficiency

From underwriting to claims processing, analytics can streamline operations and reduce costs. Automated systems can handle routine tasks, freeing up human employees to focus on more complex issues. For example, natural language processing (NLP) can analyze claim documents and extract relevant information, speeding up the claims process.

Read: The Role of Hydraulic Mules in Aviation

Digital Tools Transforming Insurance

Now that we’ve explored the power of analytics, let’s look at some of the digital tools driving this transformation:

Mobile Apps and Self-Service Portals

Gone are the days of waiting on hold to speak with an agent. Today, many insurers offer mobile apps and online portals that allow customers to manage their policies, file claims, and track their status in real time. These tools not only improve customer satisfaction but also reduce the administrative burden on insurers.

Chatbots and Virtual Assistants

AI-powered chatbots are becoming increasingly common in the insurance industry. They can answer customer questions, guide users through the claims process, and even provide personalized recommendations. For example, a chatbot might suggest additional coverage options based on a customer’s lifestyle or recent life events.

Blockchain Technology

Blockchain is best known as the technology behind cryptocurrencies, but it has significant potential in insurance too. Its decentralized and tamper-proof nature makes it ideal for managing contracts, verifying identities, and preventing fraud. For instance, smart contracts on a blockchain can automatically trigger payouts when certain conditions are met, reducing the need for manual intervention.

IoT Devices

The Internet of Things is connecting everyday objects to the internet, creating new opportunities for insurers. Smart home devices, for example, can detect water leaks or fires and alert homeowners before significant damage occurs. Similarly, wearable fitness trackers can encourage healthier lifestyles, potentially reducing health insurance claims.

Read: Apple Stock Fintechzoom – Click to explore!

Challenges and Opportunities

While the benefits of digital and analytics in insurance are clear, the journey isn’t without its challenges.

Data Privacy and Security

With great data comes great responsibility. Insurers must navigate complex regulations and ensure that customer data is protected from cyber threats. Building trust is crucial—customers need to feel confident that their personal information is safe.

Integration with Legacy Systems

Many insurers still rely on outdated systems that weren’t designed to handle modern digital tools. Integrating new technologies with these legacy systems can be costly and time-consuming.

Talent Gap

The shift to digital and analytics requires a new set of skills, from data science to AI development. Insurers must invest in training their workforce or attract new talent to stay competitive.

Despite these challenges, the opportunities far outweigh the risks. Insurers who successfully navigate this transformation will be better positioned to meet customer needs, reduce costs, and stay ahead of the competition.

Read: Ripple price fintechzoom – Understanding Volatility in a Popular Cryptocurrency

The Future of Insurance: What Lies Ahead

So, what does the future hold for the insurance industry? Here are a few trends to watch:

Hyper-Personalization

As analytics becomes more sophisticated, insurers will be able to offer increasingly personalized products and services. Imagine a world where your insurance policy evolves with your life, automatically adjusting to reflect changes in your circumstances.

Proactive Risk Management

Instead of simply reacting to claims, insurers will use data and analytics to help customers prevent losses. For example, a home insurance provider might send alerts about severe weather conditions and offer tips on how to protect your property.

Collaboration with Insurtech Startups

Insurtech startups are driving innovation in the industry, from peer-to-peer insurance models to AI-powered underwriting platforms. Established insurers are increasingly partnering with these startups to stay ahead of the curve.

Sustainability and Social Responsibility

As consumers become more environmentally conscious, insurers are exploring ways to promote sustainability. For instance, some companies are offering discounts to policyholders who drive electric vehicles or install energy-efficient home systems.

Read: Fintechzoom intel stock – Invest

How Insurers Are Leveraging AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are at the forefront of the digital revolution in insurance. These technologies are enabling insurers to process vast amounts of data, identify patterns, and make predictions with unprecedented accuracy.

Automated Underwriting

AI-powered underwriting systems can analyze applications in seconds, assessing risk and determining premiums without human intervention. This not only speeds up the process but also reduces the potential for human error.

Predictive Analytics

Machine learning algorithms can predict future trends based on historical data. For example, they can forecast the likelihood of natural disasters in a specific area, allowing insurers to adjust their policies and pricing accordingly.

Customer Segmentation

AI can analyze customer data to segment policyholders into distinct groups based on their behavior, preferences, and risk profiles. This enables insurers to tailor their marketing efforts and product offerings to meet the unique needs of each segment.

Read: FintechZoom rolex submariner – Diving Deeper into Financial Luxury

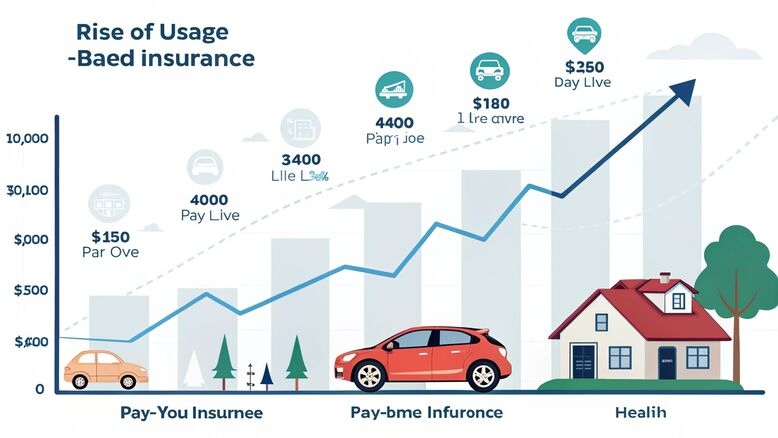

The Rise of Usage-Based Insurance

Usage-based insurance (UBI) is a growing trend that leverages digital tools to offer more flexible and personalized policies. Instead of paying a fixed premium, policyholders are charged based on their actual usage or behavior.

Pay-As-You-Drive Auto Insurance

Telematics devices track driving habits such as speed, braking, and mileage. Safe drivers can benefit from lower premiums, while those with riskier behaviors may pay more.

Pay-As-You-Live Home Insurance

Smart home devices can monitor factors like security system usage, water consumption, and energy efficiency. Homeowners who take steps to reduce risk can enjoy lower insurance costs.

Pay-As-You-Go Health Insurance

Wearable devices can track physical activity, sleep patterns, and other health metrics. Policyholders who maintain a healthy lifestyle may qualify for discounts or rewards.

Read: Fintechzoom nio stock – Taking a Closer Look at NIO Stock with a Digital Lens

The Role of Big Data in Claims Management

Big data is transforming the way insurers handle claims, making the process faster, more accurate, and more efficient.

Real-Time Claims Processing

With access to real-time data, insurers can process claims almost instantly. For example, a car accident detected by a telematics device can trigger an automatic claim, with the payout issued within minutes.

Fraud Prevention

Big data analytics can identify patterns indicative of fraudulent activity. For instance, if multiple claims are filed for the same incident, the system can flag them for further investigation.

Customer Insights

By analyzing claims data, insurers can gain valuable insights into customer behavior and preferences. This information can be used to improve products, services, and overall customer satisfaction.

Read: amd stock fintechzoom – Investment at HSI FinTechZoom

The Ethical Implications of Digital Transformation

As insurers embrace digital tools and analytics, they must also grapple with the ethical implications of these technologies.

Bias in Algorithms

AI and machine learning algorithms are only as good as the data they’re trained on. If the data contains biases, the algorithms may perpetuate or even amplify them. Insurers must ensure that their systems are fair and unbiased.

Transparency and Accountability

Customers have a right to know how their data is being used and how decisions are being made. Insurers must be transparent about their use of digital tools and analytics, and they must be accountable for any mistakes or missteps.

Data Ownership

Who owns the data generated by IoT devices and other digital tools? This is a complex question that insurers must address, balancing the need for data with respect for customer privacy and autonomy.

Read: fintechzoom simple mortgage calculator – Demystifying Homeownership

Final Thoughts

The how of digital and analytics in insurance is all about leveraging technology to create better experiences, manage risk more effectively, and drive innovation. While the journey is complex, the rewards are immense—for insurers and customers alike.

As we look to the future, one thing is clear: the insurance industry is no longer just about protecting against the unknown. It’s about using data and digital tools to shape a safer, smarter, and more connected world.

So, whether you’re an industry insider or simply someone with a policy in your name, the digital transformation of insurance is something to watch—and embrace. After all, the future is already here.

FAQs

1. What is digital transformation in insurance?

It’s the use of digital tools like AI, mobile apps, and IoT to enhance customer experiences, streamline operations, and improve risk management in insurance.

2. How is analytics used in the insurance industry?

Analytics turns data into insights for risk assessment, fraud detection, customer personalization, and operational efficiency.

3. What are some examples of digital tools in insurance?

Examples include mobile apps, AI chatbots, blockchain for secure contracts, and IoT devices like telematics for usage-based insurance.

4. How does AI help in insurance underwriting?

AI automates underwriting by analyzing data in real time, assessing risk, and setting premiums quickly and accurately.

5. What is usage-based insurance (UBI)?

UBI adjusts premiums based on actual usage or behavior, like tracking driving habits with telematics for auto insurance.

6. How does big data improve claims management?

Big data enables faster claims processing, fraud detection, and deeper customer insights for better decision-making.

7. What are the challenges of digital transformation in insurance?

Challenges include data privacy, integrating new tech with old systems, and finding skilled talent for AI and analytics.

8. How does IoT impact the insurance industry?

IoT devices like smart home sensors and wearables provide real-time data for risk assessment, loss prevention, and personalized policies.

9. What are the ethical concerns with digital insurance tools?

Ethical concerns include algorithmic bias, lack of transparency, and issues around data ownership and customer privacy.

10. What is the future of insurance with digital and analytics?

The future includes hyper-personalized policies, proactive risk management, and a focus on sustainability and insurtech collaborations.