FintechZoom has carved a niche for itself in the financial world by offering a wealth of educational resources and guidance for aspiring investors.

While their core competency might not lie in traditional financial products like credit cards, their offerings could still be a valuable asset on your path to a secure retirement.

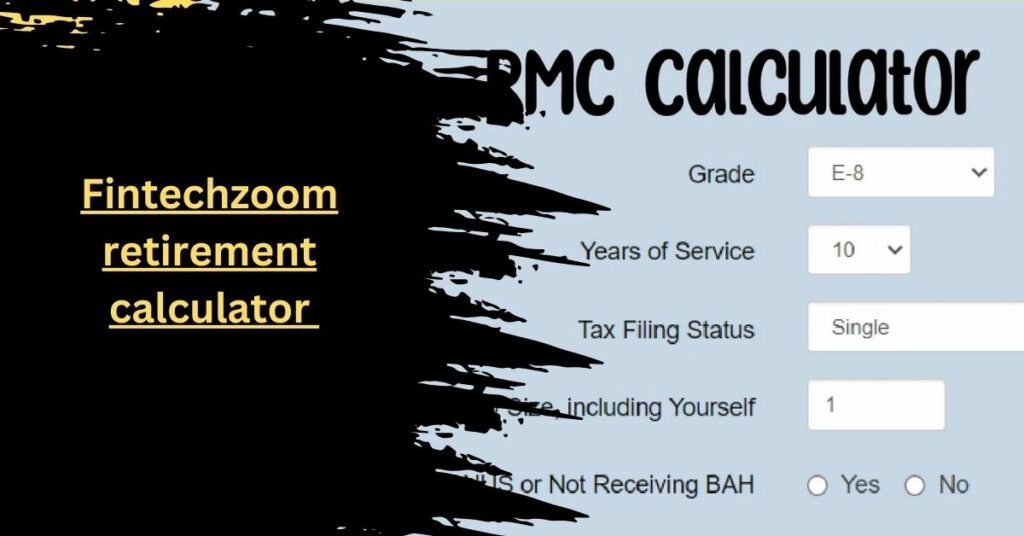

This article explores whether FintechZoom’s retirement calculator can be a helpful tool in your retirement planning journey.

Understanding FintechZoom’s Approach

FintechZoom’s approach seems to prioritize financial education over simply pushing financial products.

Their retirement calculator likely functions as part of a comprehensive suite of educational tools designed to empower users on their financial journey.

This calculator can be a springboard, allowing you to gain a preliminary understanding of your retirement readiness.

By inputting your basic financial information and observing the outputs, you can begin to identify areas that might require adjustments to ensure a secure retirement.

The act of using the calculator itself can be a valuable learning experience. As you explore different scenarios and adjust variables, you’ll gain insights into how various factors like contribution amounts, investment returns, and even retirement age can significantly impact the size of your retirement nest egg.

Strengths of a FintechZoom Retirement Calculator

Democratizing Retirement Planning:

One of the biggest strengths of a FintechZoom retirement calculator is its potential for accessibility.

Unlike complex financial planning software that might require financial expertise to operate, FintechZoom’s calculator is likely designed with the average user in mind.

This user-friendly approach can empower anyone, regardless of their financial background, to take charge of their retirement planning.

With a straightforward interface and clear instructions, even those unfamiliar with intricate financial concepts can leverage this tool to get a basic understanding of their retirement trajectory.

Interactive Learning Experience:

The FintechZoom retirement calculator goes beyond simply providing a number. It can function as an interactive learning tool.

By inputting your financial data and observing the results, you can begin to grasp the relationship between various factors and your retirement outlook.

For example, experimenting with different contribution amounts can illustrate the power of saving consistently over time.

Similarly, adjusting your assumed investment returns can shed light on the impact of asset allocation and risk tolerance on your retirement nest egg.

This interactive exploration can be a valuable eye-opener, prompting you to consider financial strategies you might not have otherwise explored.

Read: fintechzoom auto loan calculator – Exploring the Benefits

Limitations to Consider

Tailored for Typical Scenarios:

While a FintechZoom calculator can be a helpful tool, it’s important to acknowledge that it might not be able to account for every financial wrinkle.

The calculator’s accuracy might be limited for complex financial situations. Factors like unexpected inheritances, fluctuating income streams due to business ownership or side hustles, or significant healthcare needs might require a more sophisticated tool or the guidance of a qualified financial advisor.

These complexities can be difficult for a general retirement calculator to model effectively.

Limited Investment Universe:

Another potential limitation to consider is the scope of investment options offered by the calculator. The calculator might only consider a predefined set of investment options, such as mutual funds or ETFs.

If you have a unique investment strategy that incorporates alternative assets like real estate or peer-to-peer lending, these might not be reflected in the results.

This could potentially skew the accuracy of the calculator’s output for your specific situation.

Using FintechZoom Alongside Other Tools

While the FintechZoom retirement calculator can be a helpful starting point, it shouldn’t be your sole retirement planning tool. To craft a more comprehensive plan, consider taking these additional steps:

- Gather Your Financial Data:

This is the foundation of any solid retirement plan. Consolidate your financial information, including your current income, expenses, savings, debts, and any existing retirement accounts (like IRAs or employer-sponsored plans).

Having a clear picture of your current financial landscape will help you determine how much you need to save and what adjustments you might need to make.

- Explore Social Security Benefits:

Social Security benefits will likely play a role in your retirement income stream. Utilize available online resources or consult the Social Security Administration to estimate your potential benefits based on your earnings history.

Factoring in Social Security will give you a more holistic understanding of your projected retirement income.

- Factor in Healthcare Costs:

Healthcare can be an important expense, especially in retirement. Consider potential future healthcare needs and explore options like Medicare or private health insurance plans.

Estimate the associated costs and factor them into your retirement planning calculations to avoid any shortfalls down the road.

- Consult a Financial Advisor:

A qualified financial advisor can be an invaluable asset to you.

Read: FintechZoom Loan Calculator – Knowledge of FintechZoom loan calculator

FAQS

1 – Where can I find the FintechZoom Retirement Calculator?

Since FintechZoom prioritizes financial education, they likely offer the calculator on their website or financial literacy app (if they have one). Look for sections on retirement planning or financial tools.

2 – Does the FintechZoom Retirement Calculator allow for early retirement scenarios?

Yes, many retirement calculators, including potentially FintechZoom’s, allow you to input your desired retirement age.

This can help you assess if you’re on track to retire early and identify any adjustments needed.

3 – Is my financial data secure when using the FintechZoom Retirement Calculator?

FintechZoom, like any reputable financial platform, should prioritize data security. Look for information on their website regarding their data encryption practices and user privacy policies.

If you’re unsure, it’s always best to err on the side of caution and avoid entering overly sensitive financial details.

4 – How does the FintechZoom Retirement Calculator compare to other similar calculators?

Many financial institutions and investment platforms offer retirement calculators. FintechZoom’s strength might lie in its user-friendliness and focus on financial education.

However, depending on your needs, other calculators might offer more advanced features or connect you with financial advisors within their platform.

Conclusion

Don’t ditch the calculator entirely! It’s a springboard for further exploration. For a truly personalized plan, gather your financial data, estimate Social Security benefits, and consider healthcare costs.

Most importantly, consult a qualified financial advisor to craft a strategy that reflects your unique circumstances and risk tolerance. With these steps, you’ll be well on your way to a secure and comfortable retirement.

Hope this information is helpful for you.

Related Articles: