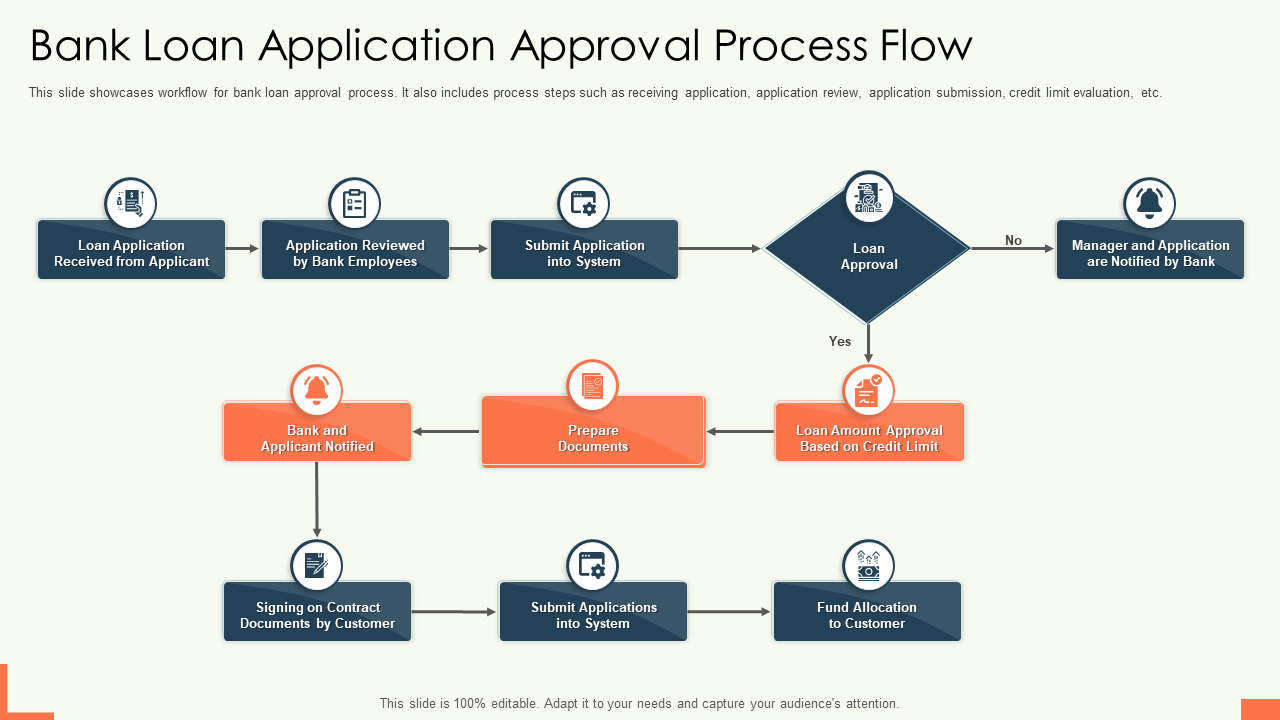

Understanding the Loan Approval Procedure for Businesses

Securing a loan is crucial for many businesses seeking to grow or cover operational costs. Understanding the loan approval procedure can make this process smoother and more predictable. This guide will walk you through the key aspects of evaluating and approving business loans.

The Basics Of Getting A Loan

The answer to how to get a business loan starts with gathering the necessary documentation. Lenders need detailed information to assess your personal information, such as financial statements, tax returns, and a solid business plan.

Your credit history plays a significant role in loan approval. Lenders look at your credit score to gauge your loan repayment ability. A higher credit score generally increases your chances of getting approved and securing better terms.

Another important factor is your business’s financial health. Lenders examine your revenue, expenses, and profitability. They want to see that your business generates enough income to cover loan repayments without straining your finances.

Preparing Your Business Plan

A well-prepared business plan is essential when applying for a loan. This plan should clearly outline your business goals, strategies, and financial projections. A detailed plan shows lenders that you have a clear vision and a strategy for growth.

Include information about how you intend to use the loan funds. Lenders need to understand the purpose of the loan and how it will benefit your business. This helps them assess the risk and potential return on investment.

Your business plan should also include an analysis of your market and competition. This demonstrates that you know the industry landscape and have strategies to succeed despite potential challenges.

Understanding Financial Statements

Lenders require financial statements to evaluate your business’s financial stability. These statements include the balance sheet, income statement, and cash flow statement, each providing different insights into your business’s financial health.

The balance sheet shows your assets, liabilities, and equity. It helps lenders understand what your business owns and owes. The income statement outlines your revenue, expenses, and profits, giving a snapshot of your profitability.

The cash flow statement is crucial for showing how money moves in and out of your business. It helps lenders assess whether you have enough cash flow to manage loan repayments and operational costs.

Assessing Your Collateral

Collateral is often required to secure a business loan. Common types of collateral include real estate, equipment, or inventory. The value and type of collateral can impact the loan terms. High-value collateral may allow you to secure a larger loan or better interest rates. Ensure that the collateral you offer is valuable and relevant to your business.

Lenders assess the collateral’s value to ensure it covers the loan amount. They may also consider the ease of liquidating the asset if necessary. Providing adequate collateral can enhance your loan application’s strength.

As per experts from Lantern by SoFi, “Yes, startups can qualify for small business loans. Qualifications will vary by lender, but most will want to see good credit scores and an in-depth business plan. You also may need to back your loan with collateral or a personal guarantee.”

The Role of Personal Guarantees

Personal guarantees are another factor in the loan approval process, which means that you, as the business owner, agree to be personally responsible for repaying the loan if the business cannot. This can be a significant commitment.

Lenders use personal guarantees to reduce their risk. If your business fails to repay the loan, they can pursue your assets. This adds an extra layer of security for the lender and can influence their decision. While personal guarantees can increase your chances of loan approval, but they also pose a financial risk. Make sure you understand the implications before agreeing to this condition.

Understanding the loan approval procedure involves knowing how to get a business loan, preparing a solid business plan, and assessing your financial statements. Collateral and personal guarantees also play significant roles in the process. By preparing thoroughly and understanding these elements, you can improve your chances of securing the loan needed to grow your business successfully.